EBF adviser: Francisco Saravia

Publication date: 4 May 2017

THE EBF FORECAST FOR THE EURO AREA ECONOMY:

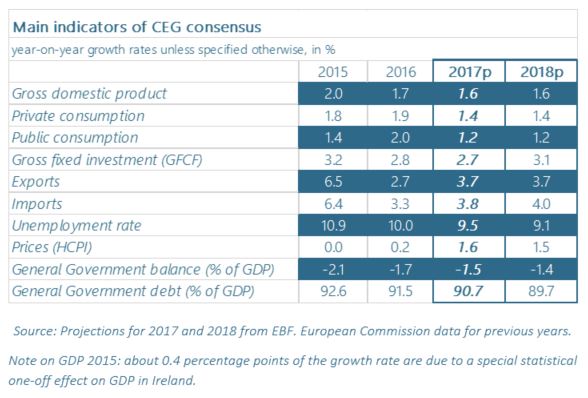

- The economy will continue its recovery, albeit at a marginal slower pace, amid continuing high political uncertainty. We foresee the euro area GDP growing a moderate 1.6 percent in 2017 and 2018.

- European banks see a substantial recovery of inflation ahead. We expect consumer price inflation to have a substantial rise to 1.6 percent in 2017 and decelerate slightly to 1.5 percent in 2018.

- Public finances will continue to adjust slowly: the euro area general government budget deficit will be 1.5 percent of GDP this year, and 1.4 percent of GDP in 2018.

- Economic growth is expected to be sufficiently strong to ensure that labour markets will continue to improve over the forecast horizon. The jobless rate is forecast to be 9.5 percent in 2017 and 9.1 percent in 2018.

THE EBF CHIEF ECONOMISTS’ GROUP CONSENSUS

The Chief Economists’ Group of the European Banking Federation expects the euro area to continue the economic recovery supported by a highly expansive monetary policy, stronger labour markets and a better global outlook. GDP growth is forecasted to reach 1.6 percent in both 2017 and 2018. However, growth could be stronger if it was not for the significant political uncertainty and geopolitical tensions which are presently surrounding the world economy. These risks keep investment activity and world trade low in comparison to periods of more stable and better predictable external conditions.

While private consumption has been an engine for growth in Europe, the rising inflation will take its toll of consumption also corresponding with a diminished GDP growth compared to previous years. We expect private consumption to grow by 1.4 percent in both 2017 and 2018. Fixed business investments will grow by 2.7 percent in 2017 and slightly strengthen throughout 2018 to a 3.1 percent growth.

Inflation is currently expanding by its fastest pace in several years largely due to the rising oil prices. This will push the increase in consumers’ prices to 1.6 percent in 2017, up from 0.2 percent in 2016, while the inflation rate will decelerate slightly to 1.5 percent in 2018. This scenario suggests that inflation will, for first time in years, lie closer to the ECB target of price stability; close to, but below 2.0 percent. Core inflation (which excludes volatile items like commodities, energy and non-processed food) is however increasing at a somewhat lower rate of just 1.1 percent in 2017 and 1.3 percent in 2018.

Growth stabilization in most emerging countries and solid growth in the advanced economies will help to reach a gradual recovery of the global economy which should enhance European exports. We thus forecast exports to grow by 3.7 percent this year and next.

Economic growth is expected to be sufficiently strong to ensure that labour markets will continue to improve over the forecast horizon. After reaching 10 percent in 2016, our forecast for the euro area foresees unemployment at 9.5 percent in 2017, with a further improvement to 9.1 percent, in 2018, the lowest rate to be recorded in the euro area in a decade. These figures will continue to mask uneven rates across the euro area countries in which the unemployment rate remains high. The unemployment, still high, will keep wage pressures contained. Our consensus expects wages to increase by 1.6 percent in 2017 and a slightly higher 1.8 percent in 2018.

Oil prices fell by some 75 percent during 2014 and 2015, before recovering sharply in 2016. On back of the expectation that the OPEC countries will stick to their current production quotas our consensus forecast for the oil price (Brent) in 2017 is around USD 55 and USD 59 in 2018.

The ECB is expected to begin a gradual reduction of the expansionary monetary policy during the forecast horizon. This is expected to lead to a slight appreciation of the euro against the dollar from the end of 2017. The Chief Economists’ Group’s consensus forecast for the euro/dollar exchange rate in 2018 is 1.11 with a relative wide margin between 1.05 and 1.20.

RISK TO THE SCENARIO

The CEG’s consensus remains surrounded by a number of both upside and downside risks.

1. UPSIDE RISKS

- A faster recovery of the global economy as global trade is slowly gaining some strength and confidence indicators remain strong, implying a self-fulfilling upswing.

- The President Juncker’s Investment Plan for Europe may start generating effects, albeit moderate in the economy, thus supporting the euro area growth in 2018.

2. DOWNSIDE RISK

- The uncertainty related to the political events in Europe with France, Germany and possibly Italy holding elections later in the year. Disrupting outcomes may trigger prolonged uncertainty.

- The level of complexity of the Brexit negotiations and the relative short time (until March 2019) in which to reach a final deal.

- Increasing global protectionism, in particular, by an aggressive US trade policy, could trigger trade conflicts that would harm the global economy.

- The slowdown of the Chinese economy might well materialise which would, inter alia, affect the euro area’s trade exposure and investment to China.

The risks to the growth outlook are fairly balanced, according to the Chief Economists’ Group