Publication date: 26 November 2018

k

EBF adviser: Francisco Saravia

EBF economists forecast Euro area GDP growing by 2.0 percent in 2018 and by 1.8 percent in 2019

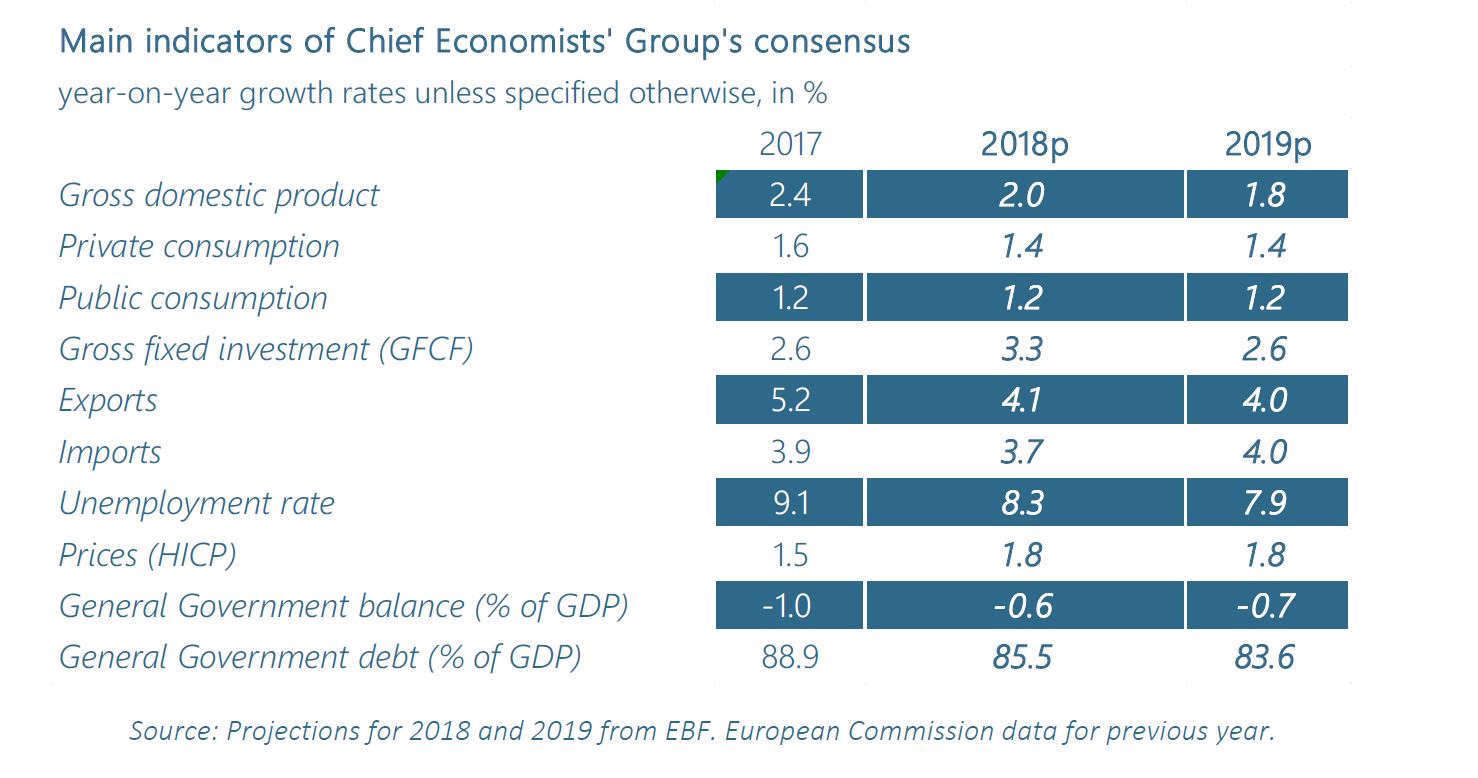

The Chief Economists’ Group of the European Banking Federation expects economic growth in the Euro area to continue above trend, albeit at a lower pace, and despite lower growth dynamics expected for the next quarters to come. The slowdown in the pace of the economic growth in the 19-country bloc is mainly attributed to temporary country-specific factors and an easing of foreign demand. The Euro area economy will continue growing in the forecast period benefiting from sustained domestic demand, accommodative monetary and fiscal policies, and strong labour market performance. The main downside risks remain the internal uncertainty illustrated by political jitters in Europe and an external environment with weaker global trade and lingering protectionism. We expect the Euro area to expand, offsetting uncertainty and tempered global demand, by 2.0 percent in 2018. Growth is expected to cool down slightly in 2019 with a projected GDP growth of 1.8 percent.

Highlights from the EBF forecast:

- The Euro area economic growth will continue to expand, albeit at a lower pace. We foresee the Euro area GDP growing by 2.0 percent in 2018 and by 1.8 percent in 2019.

- European banks see inflation stabilising. With our forecast of an inflation rate of 1.8 percent in 2018 and 2019, the ECB’s medium-term objective of price stability -below, but close to 2.0 percent- is more or less achieved.

- Public finances have improved. The Euro area’s general government budget deficit will be 0.6 percent of GDP in 2018, down from 1.0 percent in 2017. In 2019, it will remain about the same level i.e. 0.7 percent of GDP.

- Labour markets will continue to improve over the forecast horizon. The jobless rate is forecast to be 8.3 percent in 2018 with a further improvement to 7.9 percent in 2019.

kkkk

Risk to the scenario

The CEG’s consensus remains surrounded by a number of both upside and downside risks.

1. Upside risks

- Soft landing of the US economy accompanied by neutral monetary policy.

- Stronger than expected domestic demand growth if wage dynamics pick up more decisively.

- Expansionary fiscal policies in some Euro area countries (which have real budgetary room for manoeuvre), potentially bringing support to Euro area economic growth.

- Stabilisation of global economic activity leading to slight acceleration of Euro area exports.

- Succesfull political monitoring of the ‘Italian risk’ and a Brexit outcome that is economically acceptable.

2. Downside risk

- Escalation of the fiscal conflict in Europe with a clash between the European Commission and Italy -Euro area’s third biggest economy- over Italy’s government budget plans.

- Worsened trade outlook with further escalation of trade tensions between the US and China triggering a trade battle that would harm the global economy. The Euro area economy, that is relatively highly exposed to external trade, would be severely hit if EU-US trade frictions materialise and US tariffs are imposed on EU sectors.

- Although negotiations between the European Union and the United Kingdom seem to be progressing, as seen by the recent draft agreement on the withdrawal of the United Kingdom from the European Union, the final outcome remains a major concern.

- Further slowdown of global growth with weakened emerging economies.

- Increasing geopolitical tensions having the potential to spark a period of further decline in world trade.