STATISTICAL ANNEX

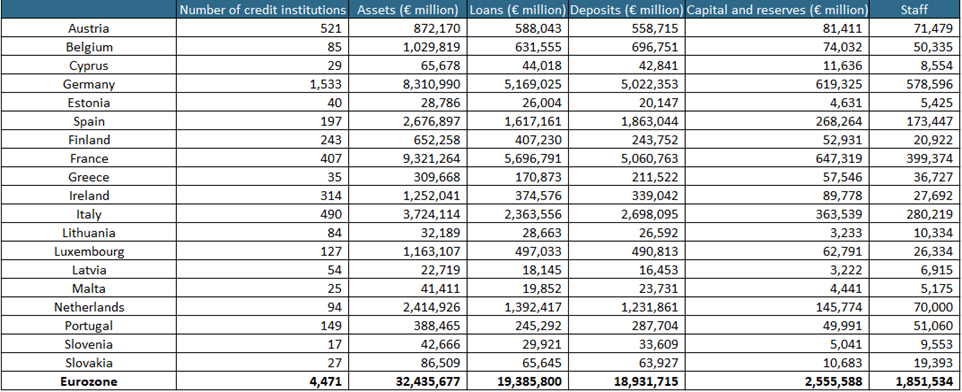

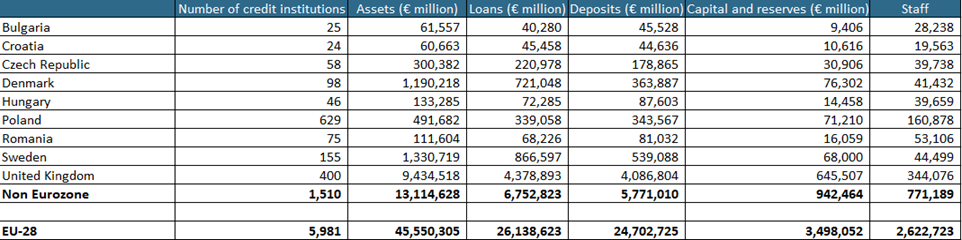

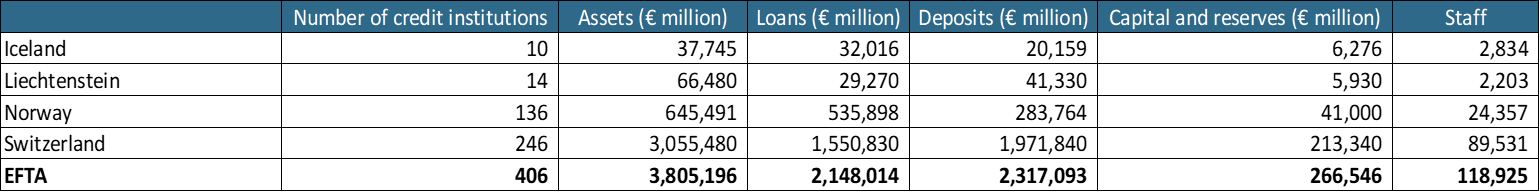

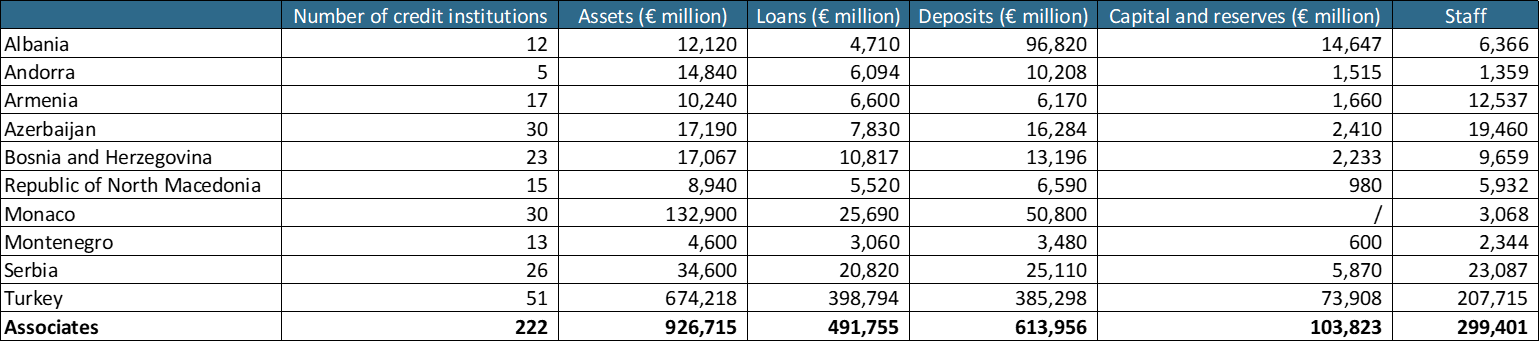

All figures as at 31 December 2019.

Amounts in € millions.

Unless otherwise noted, all data, graphs and tables have been produced to illustrate EU 28 data. The EU 28 data contained in the statistical annexe has been compiled from publicly available information released by the European Central Bank unless otherwise noted. The data relevant for EFTA countries and EBF Associate Members have been compiled from the corresponding national central bank, financial supervisory authority, national office of statistics and national banking associations members of the European Banking Federation.

Country-by-country statistics – Euro area Member States

Country-by-country statistics – Non-euro area EU Member States

Country-by-country statistics – EFTA Member States

Country-by-country statistics – EBF Associate Members

The focus of this publication is on banks; however, the pure data on banks is not available from the ECB. For this reason, the EBF uses both the Credit Institutions (CI) and the Monetary Financial Institutions (MFI) depending on which type of data is available. Since banks represent around 75-80% of the entire financial system in the EU, the EBF deems it feasible to base the analysis of the banking sector on the ECB’s CI and MFI data. For your convenience, the ECB definitions of CI and MFI are presented below:

Credit Institution (CI) = Any institution that is either (i) an undertaking whose business is to receive deposits or other repayable funds from the public and to grant credit for its own account, or (ii) an undertaking or any other legal person, other than those under (i), which issues means of payment in the form of electronic money.

Monetary Financial Institution (MFI) = Financial institutions which together form the money-issuing sector of the euro area. These include: the Eurosystem, resident credit institutions (as defined in EU law) and all other resident financial institutions whose business is to receive deposits and/or close substitutes for deposits from entities other than MFIs and, for their own account (at least in economic terms), to grant credit and/or invest in securities. The latter group consists predominantly of money market funds.