Social dialogue should be promoted at all levels, as the Union’s social dialogue can only work when built on strong, autonomous national social partners

The Social Partners must come together to find good answers not only to the challenges that lie ahead in the banking sector, but also to maintain and promote the way of living the togetherness of employees and employers in the European Social model

A well-balanced regulatory environment which ensures a level playing field with all the other players is essential in order to maintain a healthy and sustainable European banking sector

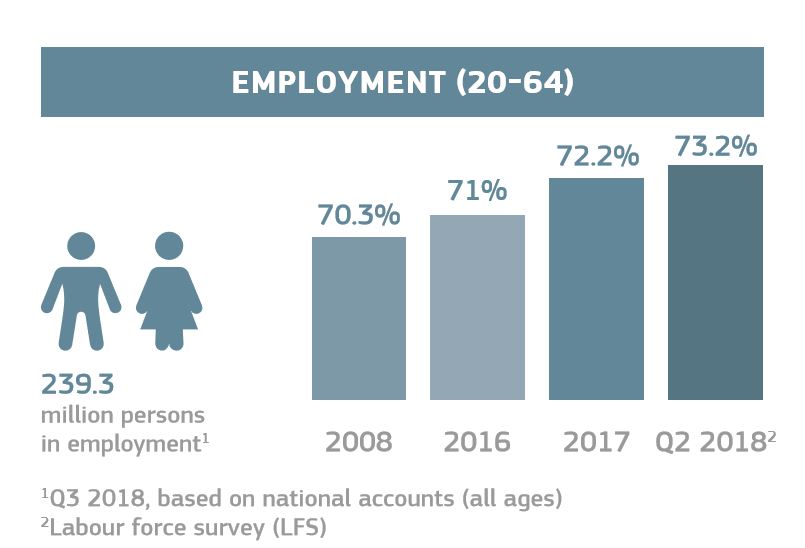

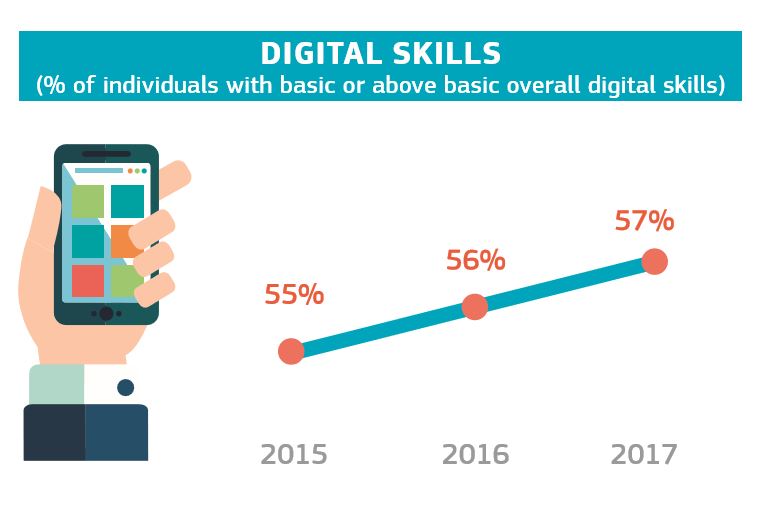

EUROPEAN SEMESTER 2019: KEY FIGURES

Source: European Commission – See full infographic

SOCIAL DIALOGUE IN THE BANKING SECTOR

- EBF Banking Committee for European Social Affairs (EBF-BCESA) is the EBF’s competent committee for all social affairs issues falling under the scope of the European Sectoral Social Dialogue (SSD) in Banking

- Liaison Forum meetings among European social partners arranged by the European Commission on latest developments in the field of social dialogue

- Representativeness Study for the Banking Sector: overview report by the European Foundation for the Improvement of Living and Working Conditions (Eurofound)

EUROPEAN SOCIAL PARTNERS IN THE BANKING SECTOR

The EBF-BCESA together with the other organizations mentioned below are the Social Partners on the employers’ side in the Sectoral Social Dialogue for the Banking sector

The EBF-BCESA together with the other organizations mentioned below are the Social Partners on the employers’ side in the Sectoral Social Dialogue for the Banking sector

European Savings and Retail Banking Group (ESBG)

European Association of Co-operatives Banks (EACB)

The European Social Partner in the banking sector on the employees’ side is UNI Europa Finance

OTHER STAKEHOLDERS

Directorate General Employment, Social Affairs and Inclusion (DG EMPL) of the European Commission

.

.

The EBF-BCESA is also member of European Employers’ Network (EEN) established in the 1990s as a voluntary, informal network. Participants include BusinessEurope and representatives of European-level sectoral employers’ and business organisations which are actively involved in European employment and social policy, including in the context of Sectoral Social Dialogue Committees (SSDC).

EUROPEAN SOCIAL PARTNERS’ INITIATIVES

Declarations and Statements

- European Social Partners for the Banking Sector publish new Joint Statement to reaffirm commitment to preventing Violence and Harassment at Work – EBF

- European Banking Social Partners Commit to a Common Understanding on Remote Work signed on 7th December 2021

- The Joint Declaration on Employment Aspects of Providing Financial Services including Guidance signed on 7th May 2020 by European Social Partners

- The Joint statement of the European Social Partners in the Banking and Insurance Sectors on the COVID-19 Emergency Crisis signed on 30th March 2020

- The new Joint Declaration on the impact of digitalisation on employment has been signed on the 30th of November 2018 by the European social partners in banking sector.

- The Joint declaration on telework in the European banking sector has been signed on 17 November 2017 by the European social partners.

- Experienced older workers in high demand as EU banks seek staff competent in regulation

- EU social partners signed a joint conclusion and recommendations regarding Lifelong Learning/Elargement Joint Project

OTHER INITIATIVES

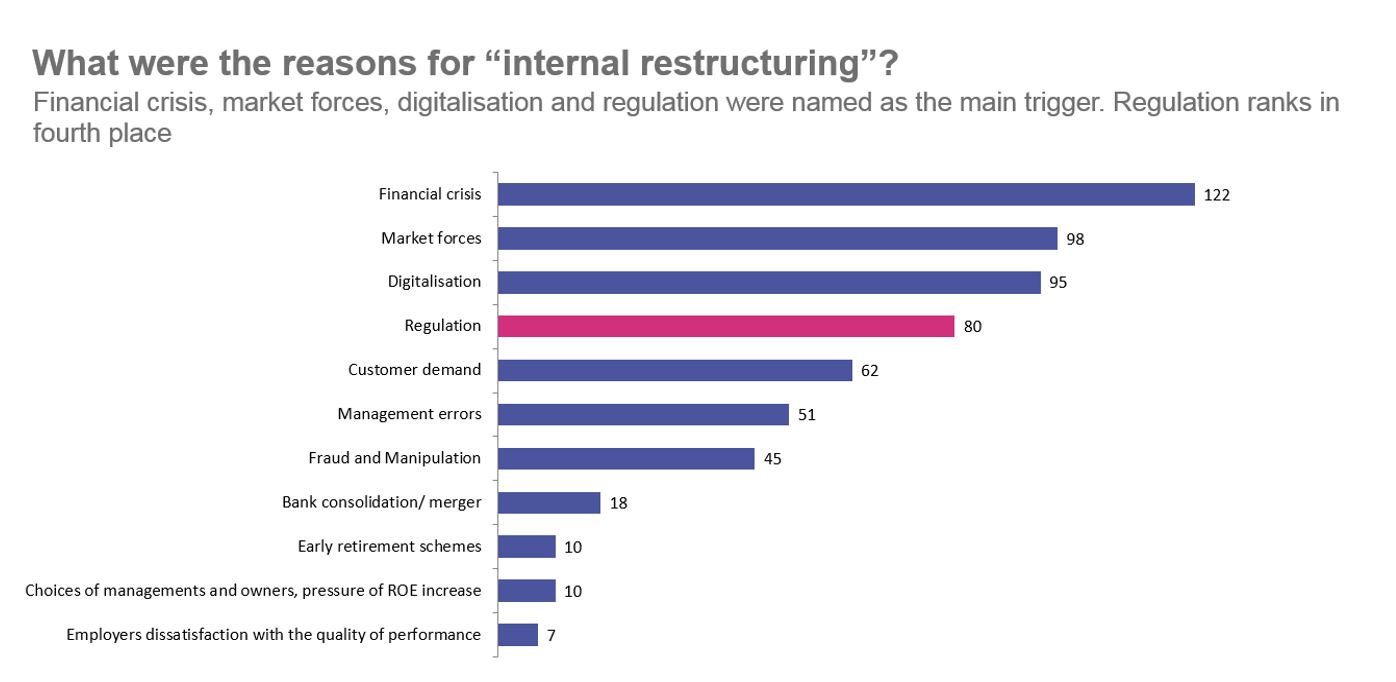

The European Social Partners (UNI Europa Finance, EBF-BCESA, ESBG and EACB) recently concluded the two-phased European Commission funded project “Impacts of Regulation on Employment in the European Banking Industry”.

- The first pillar (2017-2018) consisted of an initial mapping of the employment situation as well as the regulatory status quo in Europe’s banking sector since the start of the 2008 financial crisis. The main findings of this first phase were that the financial crisis, the growth of digitalisation, market changes, and a continuously increasing and complex EU regulatory regime have all created new trends in banking sector employment.

- The follow-up project pillar II (2019-2020) was aimed to further evaluate whether increasing regulation has led to positive or negative developments for Europe’s banking sector and its workers. The report showed an increase in the costs of doing business including compliance costs, capital requirements and additional compliance costs derived from risk monitoring practices mandated by law such as Anti-Money-Laundering rules.

Read here the Social Partners’ Project Conclusions.

EBF POSITION PAPERS BEFORE JANUARY 2017

08/05/2012 – EBF-Banking Committee for European Social Affairs’ answer to the Commission’s public consultation on:“Restructuring and anticipation of change: what lessons learned from recent experience?”