“Today, platforms have more influence and market power than anyone could have imagined”

“[…]That is, platforms must perform a balancing act with respect to their price structure as well as other policy dimensions; quite generally, they encourage positive externalities and discourage negative ones and to do so usually constrain one side to the benefit of the other.”

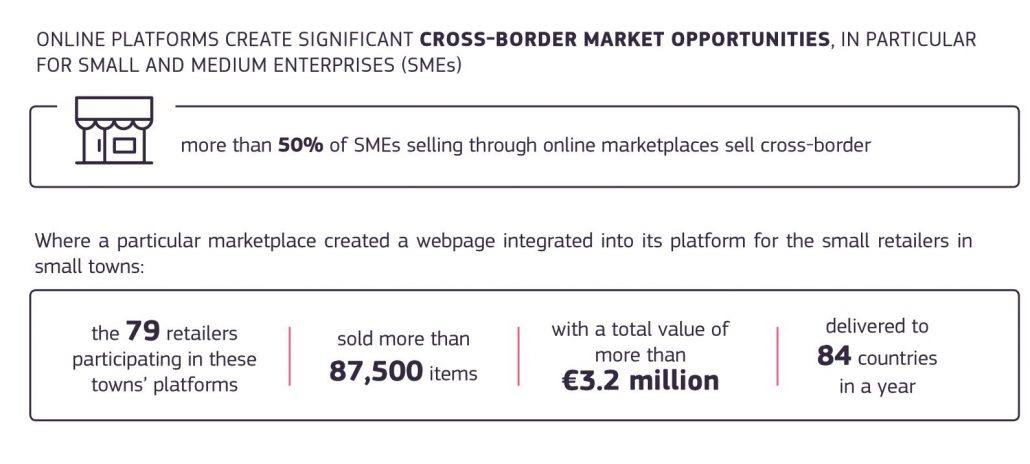

Platform-enabled online intermediation of goods and services has dramatically changed the digital economy. Some of the most successful and fastest scaling businesses of the last decade are built on the platform business model. . This way, they underpin the effective functioning of the digital single market and the economic growth of the EU. Online platforms, legally captured under the term of “providers of online intermediation services”, create a plug-and-play infrastructure that enables producers (business users) and consumers to connect and interact with each other in a manner that was not possible in the past. The direct interaction between providers of products and services and customers offers the latter a one-stop-shop for what they want, when they want and in a format they prefer (choice, affordable products, fast delivery). As a result, platforms have become one of the cornerstones of e-commerce and digital markets, helping to reshape the very design of traditional business models and marketing activities.

Platform-enabled online intermediation of goods and services has dramatically changed the digital economy. Some of the most successful and fastest scaling businesses of the last decade are built on the platform business model. . This way, they underpin the effective functioning of the digital single market and the economic growth of the EU. Online platforms, legally captured under the term of “providers of online intermediation services”, create a plug-and-play infrastructure that enables producers (business users) and consumers to connect and interact with each other in a manner that was not possible in the past. The direct interaction between providers of products and services and customers offers the latter a one-stop-shop for what they want, when they want and in a format they prefer (choice, affordable products, fast delivery). As a result, platforms have become one of the cornerstones of e-commerce and digital markets, helping to reshape the very design of traditional business models and marketing activities.

Under the current form of banking, banks usually act as business users of third-party platforms, for example in order to:

• provide financial services (e.g. consumer credit intermediated through an online comparison platform),

• provide different banking apps via a platform ecosystem,

• interact with customers via social media or voice banking platforms.

However, banks may also serve as online intermediation service providers either in the present or in the future. In that role, a bank could develop and own a digital platform, which could serve as a “digital marketplace” where financial or non-financial products and services could be offered by third-party business users to (the bank’s) customers.

The European Banking Federation welcomes the Digital Services Act package, a single set of new rules applicable across the whole EU, which will create a safer and more open digital space, with European values at its centre. Our specific comments on the Commission’s open consultation can be found in our

The European Banking Federation welcomes the Digital Services Act package, a single set of new rules applicable across the whole EU, which will create a safer and more open digital space, with European values at its centre. Our specific comments on the Commission’s open consultation can be found in our