“A complete Banking Union is essential for the future of the Economic and Monetary Union and for a financial system that supports jobs and growth.”

“The completion of the Banking Union is about making sure that the European banking sector is one banking sector. We need to make sure that when an investor looks at banks in Europe, they see a European bank – whether they see it from Milan, Frankfurt or Paris.”

“Good supervision is based as much on judgement as on rules. Supervisory judgement is crucial in order to accommodate the individual situation of each bank; it should not be confined by overly detailed rules. In particular, this is crucial in a rapidly changing financial landscape in which rules and regulations simply cannot keep up. Here, we need to thoroughly understand evolving risks within and across banks, and we need to address them by taking a dynamic and forward-looking supervisory approach.”

Supervision

Established platform for the dialogue between banks and the European Central Bank

Banking supervision in the banking union

The EBF supports financial market integration in Europe. The initiative for a Banking Union is instrumental to achieving a more integrated European banking system. The establishment of the ECB Single Supervisory Mechanism is a decisive step that not only affects the supervised banks but also constitutes a point of reference for banks and other supervisors from all over Europe and worldwide.

The EBF supports financial market integration in Europe. The initiative for a Banking Union is instrumental to achieving a more integrated European banking system. The establishment of the ECB Single Supervisory Mechanism is a decisive step that not only affects the supervised banks but also constitutes a point of reference for banks and other supervisors from all over Europe and worldwide.

The EBF has engaged in this endeavor from inception, in 2014. The implementation of the new SSM supervisory culture requires a lot of coordination, timely and effective communication as well as mutual understanding between all parties. In this journey, numerous operational difficulties arise. The EBF collaborates with the ECB in the identification and solution of problems and circumstances that deserve special attention from banks and supervisors.

Informed dialogue EBF-ECB

EBF SSM Boardroom Dialogue

EBF Expert Working Groups

EBF SSM Strategy Group

EBF Chief Economists Group

CEO Roundtable

Pictures from the EBF SSM Boardroom dialogue

Pictures from the EBF SSM Boardroom dialogue

Which issues we discuss with ECB?

Operational issues and strategic themes

Stress Testing

Cybersecurity

Reporting and Statistics

Recovery & Resolution planning

Targeted Review of Internal Models

Interest Rate Risk

Market Risk

Counterparty Credit Risk

On-site Inspections

Risk Reduction and Non performing loans

Leveraged lending

And other operational issues

Supervisory Review and Evaluation Process

Monetary Policy

SSM Risk Map

Brexit

Profitability

Fit & Proper assessment process

SSM Supervisory Priorities

Improvement of supervisory practices

Supervision of Less Significant Institutions

Macroprudential supervision

European Banking Institute (EBI)

And other strategic themes

EBF scope and activity

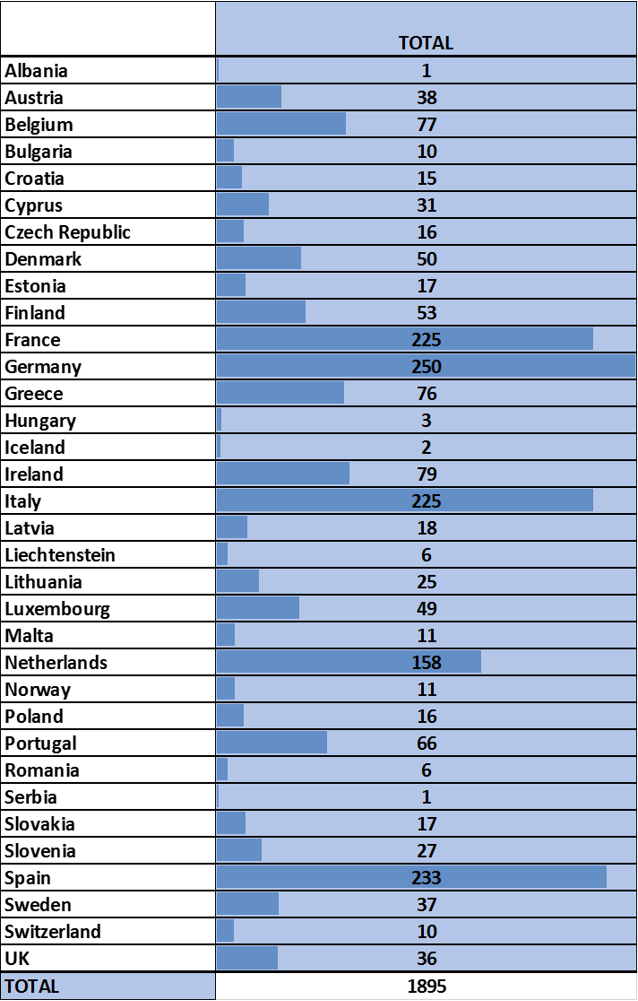

Number of bank participants by country in EBF meetings with ECB in Frankfurt from 2015 to mid-2020

The EBF serves as the voice of the European banking sector, uniting 32 national banking associations from the European Economic Area plus other European countries that collectively represent some 3,500 banks – large and small, wholesale and retail, local and international.

Our teams are made of bank experts from all European countries who engage in a continuous dialogue with the ECB managers about strategic and operational issues.

From 2014, the EBF has organised more than 100 events and meetings with the ECB in Frankfurt involving bank managers and staff from across Europe.