What is the PMWG working on?

Capital Markets Union

The PMWG is working alongside the Steering Committee for Financing Growth of the EBF in support of the Capital Markets Union reform project to create truly integrated capital markets in Europe. Members of the PMWG focus on issues concerning issuance and underwriting of new securities, market financing of companies, IPOs, recapitalization, equity culture and green and social bonds.

Among the most notable dossiers are:

-

European Single Access Point (ESAP) for accessible and comparable company data.

The EBF supports a simple, relevant, reliable, decision-useful and user-friendly ESAP to facilitate reporting for market participants. ESAP should facilitate the bank’s reporting obligation under the EU legislation (e.g. NFRD, Taxonomy Regulation, SFDR) but also facilitate the risk management and steering lending and investment portfolios towards the net;

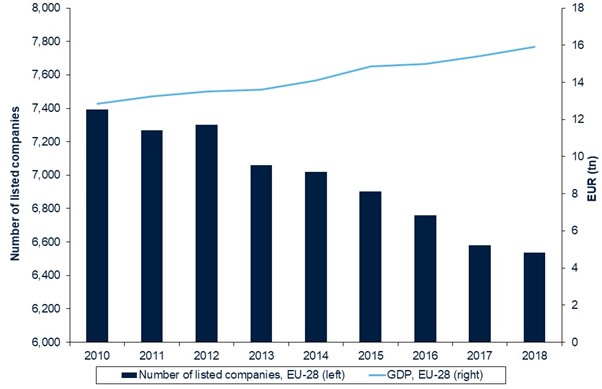

Simplification of the listing rules is necessary to reduce the costs for SMEs as well as the time-to-market involved. Members are also at work to support the establishment of a legal/regulatory framework favourable to IPOs;

A security prospectus is an essential regulatory requirement for companies to access capital. As part of its capital markets union action plan, in June 2017 the EU adopted a Regulation (EU) 2017/1129 to improve the prospectus regime by making it easier, cheaper, more flexible and investor-friendly.

In the context of Covid-19, the EBF welcomed the introduction of a new “EU Recovery Prospectus” – a type of short-form prospectus – to facilitate the raising of capital in public markets.