EBF advisor: Denisa Avermaete

Publication date: 26 February 2019

The European Banking Federation has responded to the European Commission’s Technical Expert Group consultation on the usability of the taxonomy

EBF Executive summary :

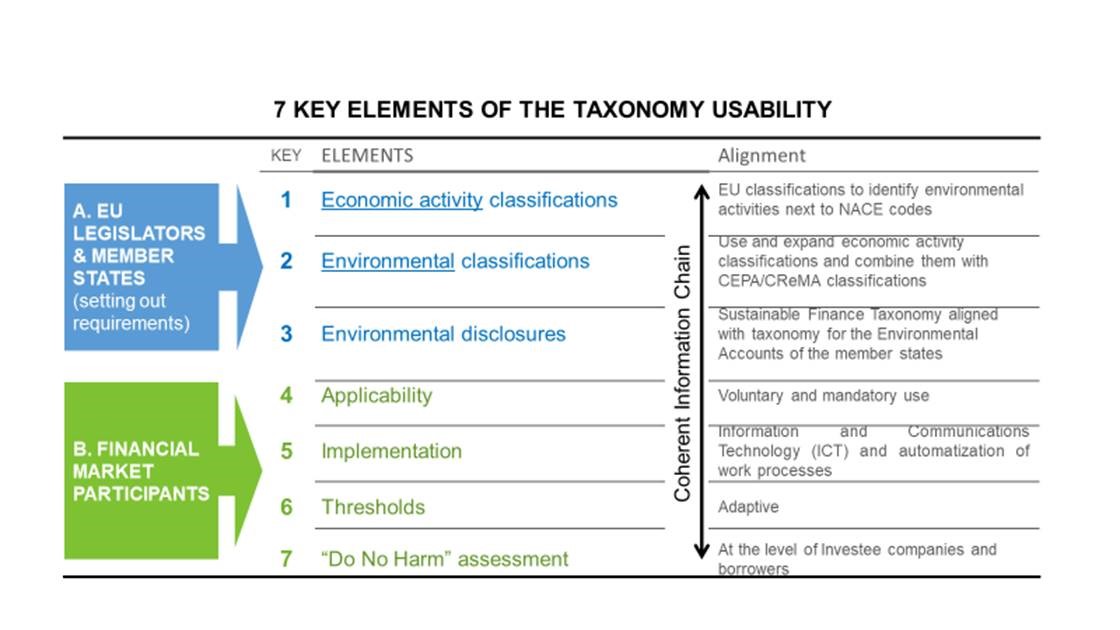

Taxonomy should be seen as a common language that could be applied by all (financial and non-financial) market participants to all their activities. The usability of the taxonomy will depend mainly on the way the taxonomy will be implemented.

Automatization of the processes and integration into the IT systems has a great potential for acceptance, successful adoption and implementation of the taxonomy. Taxonomy should be a system with well-defined environmental activity codes, which can be used to originate financial products, to make automated selections of investments or to verify compliance of these with the taxonomy.

A first KEY element of usability is alignment of the Taxonomy with existing economic activity classifications, to the maximum extent possible.

A second KEY element of usability is alignment of the Taxonomy with existing environmental classifications to the maximum extent possible.

The point of the taxonomy should be to define what part of an activity can be deemed sustainable. The existing NACE codes will never be sufficient for this purpose; therefore it is necessary to use additional codes for the purpose.

We suggest:

- Using and expanding existing activity classifications including NACE, of the revised European system of integrated statistical classifications, the which distinguishes between activities (NACE), products (CPA) and goods/services (PRODCOM/CN); and

- Classifying each of them into 16 environmental CEPA/CReMA purposes/domains.

A third KEY element of usability is alignment of environmental disclosures. Sustainable Finance Taxonomy must be fully aligned with the taxonomy for the Environmental Accounts of the Member States, otherwise Member States will report different environmental investment figures than those of Financial Market Participants. If Member States would share data with financial market participants then sustainable finance disclosures can be (as much as possible) automated.

A fourth KEY element of usability is its applicability. It is important to distinguish between voluntary and mandatory use of the taxonomy. It should be possible for all market participants to apply the taxonomy as a common comprehensive framework or classification system to all activities, products and services on a voluntary basis while requiring the financial products, marketed, to be sustainable.The taxonomy also needs to be simple enough so that those who are supposed to use it in their investment decision-making can understand it..

A fifth KEY element of usability is the possibility to implement the taxonomy in ICT systems and work processes. The codes are necessary to enable an automated selection of companies, projects, assets and products/services for green financing/investment and to generate the “allocation or use-of-proceeds report” for the environmentally labeled financial products Manual solutions for selection/verification and reporting are labour intensive, too expensive and “out of the question”. We encourage and support a a system of robust classifications and codes that can be used in an automated way.

A sixth KEY element of usability is the threshold. We recommend to leave it to the market the definition of these thresholds, and only describe the process of how market participants can define thresholds, and the management and documentation of the results.

The seventh KEY element is the application of the do no harm assessment . It should be allowed, as an alternative, to assess the sustainability at the level of the investee companies and borrowers. Financial Market Participants must be able to continue using tools like sustainability/ESG ratings, which are always at the level of the corporate/company. Sustainability ratings are not available at the level of sub-activities.

Lastly, we need a coherent information chain. Companies need to disclose the relevant information with regards to the types of activity so that market players can identify what can be considered sustainable or not when marketing financial products as sustainable. Currently, the onus is put on financial market players when the information in many instances is not available. At the same time, we acknowledge that it may be both challenging and costly for companies, especially SMEs, to provide the information and data necessary for the assessment. If client companies are not in the position to provide the data required by the taxonomy, and as a consequence, these will not be available to banks, there is a risk of under-representation of the environmentally sustainable sectors owing simply to the information gap (this risk appears particularly relevant in the case of the credit business, which is relevant to investment too because of origination). As a result, the TEG should verify, not only the fit for purpose of the metrics, but also their simplicity in order to avoid creating unjustified competitive disadvantage for SMEs.